Introduction to Income Declaration

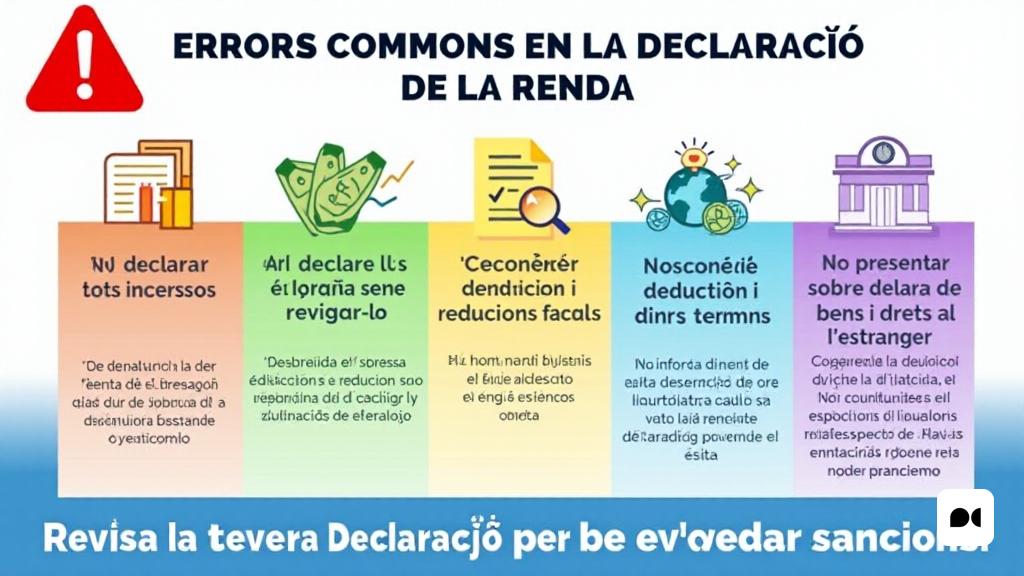

Each year, Spanish taxpayers face the responsibility of presenting their income statement. Despite being a regular task, it is easy to make mistakes that can trigger complications with the Tax Agency. In this article, we will analyze the most common mistakes and how to avoid them to ensure a correct statement.

Error 1: Revenue omission

One of the most common mistakes is not to declare all revenue received during the year. This includes salaries, unemployment aids, rent income and investment gain. If all income is not declared, the Treasury may consider it a tax offense, which can lead to economic sanctions.

Error 2: Accept draft without checking

Many taxpayers choose to accept the draft prepared by the Treasury without reviewing it. It is important to keep in mind that although the agency uses available information, it may not be completely accurate or updated. Reviewing and correcting data is essential to avoid errors that could lead to sanctions.

Error 3: Ignore applicable deductions

The Spanish tax system offers various deductions that can help reduce the amount to be paid. Not knowing these deductions or applying them incorrectly is a common error. For example, expenses for investments in habitual housing or donations to non -profit organizations may be deducted.

Error 4: Late Presentation

Presenting the income statement outside the term may lead to adverse consequences. Even if no taxes are due, late submission may result in sanctions. If the statement is submitted after the deadline without a request for the Treasury, a 1% surcharge will be applied each month delay.

Error 5: Do not declare property abroad

Many taxpayers forget to declare property and rights that they have outside of Spain, such as bank accounts or properties. This omission can be considered a serious violation, with sanctions that could exceed 150% of the unrepared value. It is essential to be transparent and include all the relevant information.

Tips to avoid errors in the statement

To avoid problems with the Treasury, it is advisable to follow these tips: to carefully review the draft of the statement, to ensure that all income is declared, to investigate applicable deductions, to present the declaration within the established period and to be honest about property and rights abroad.

To maintain accuracy and transparency in the tax return not only helps to avoid sanctions, it also helps to fulfill the tax responsibilities effectively.