A Major Shift in Fiscal Policy

In a significant move that could reshape the fiscal landscape, House Republicans have successfully passed a comprehensive tax and spending bill early Thursday morning. This ambitious legislation is projected to increase the national debt by an astonishing $3.3 trillion, as indicated by initial estimates.

Key Provisions and Implications

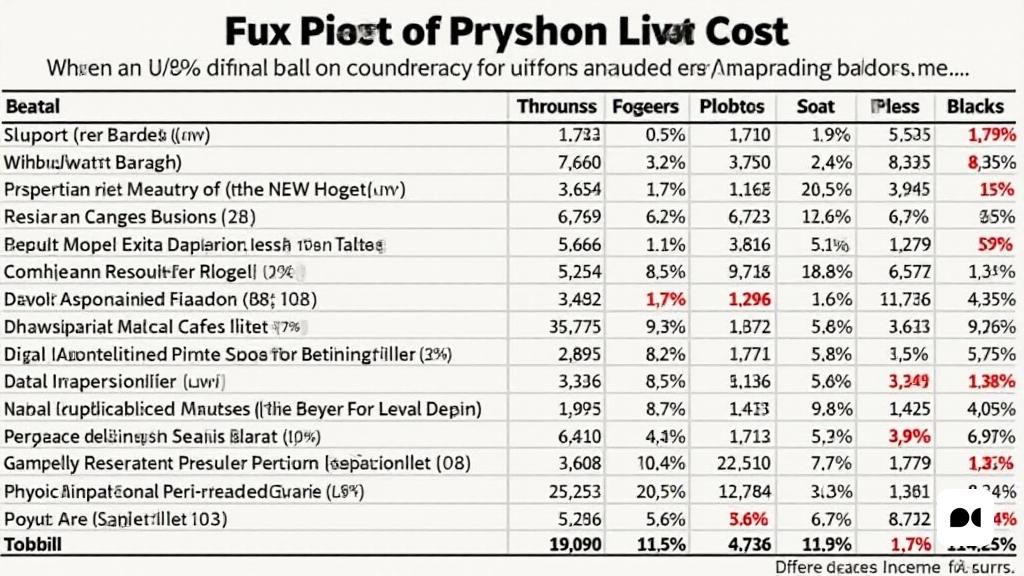

Among the myriad of changes proposed in the bill, several provisions stand out due to their potential fiscal impact. The Congressional Budget Office (C.B.O.) has conducted an analysis, revealing the estimated 10-year costs or savings associated with each provision, although it’s worth noting that some last-minute amendments were not included in this evaluation.

Tax Cut Extensions and Their Costs

The proposed legislation includes several significant tax cuts that, if implemented, could lead to a substantial reduction in federal revenue. Here’s a summary of the major tax cut extensions:

Notable Tax Cuts

1. **Lower Marginal Tax Rates**: The bill aims to permanently maintain reduced tax rates, which could cost the government approximately $2.2 trillion over the next decade.

2. **Standard Deduction Enhancements**: A temporary boost to the standard deduction, lasting until 2028, is projected to incur a $1.3 trillion expense.

3. **Child Tax Credit Increase**: An additional $500 per child is proposed through 2028, amounting to nearly $800 billion.

Controversial Cuts and Regulatory Changes

The bill also includes controversial cuts and regulatory changes that could affect various sectors. For instance, it seeks to eliminate certain tax exemptions and impose new limitations on deductions. These alterations could significantly shift the balance of federal revenue.

Potential Risks and Future Outlook

As the bill now transitions to the Senate, experts predict substantial modifications. The potential for significant shifts in fiscal policy raises concerns about long-term economic stability. Stakeholders across various sectors are closely monitoring these developments, anticipating the implications for businesses and taxpayers alike.

Conclusion: Navigating Uncertain Waters

The passage of this bill marks a pivotal moment in U.S. economic policy, reflecting a bold Republican strategy that could reverberate through future budgets and fiscal health. As the Senate prepares to deliberate, the focus will be on whether bipartisan support can be garnered to navigate these complex and contentious issues.