The Allure of Gold in Uncertain Times

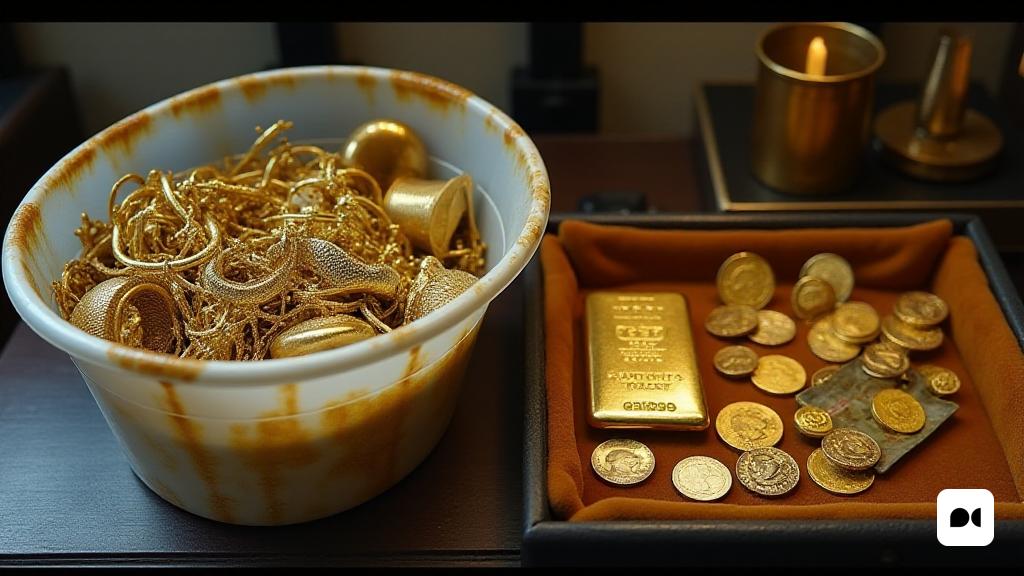

In an era marked by economic unpredictability, gold has once again captured the imagination of investors. Emma Siebenborn, a strategist at Hatton Garden Metals, reveals a collection of gold artifacts that represent both nostalgia and opportunity. This assortment, which includes worn jewelry and precious coins, symbolizes the current gold rush, driven by a surge in demand as prices climb.

Current Market Dynamics and Historical Context

Gold prices have soared over 40% in the past year, recently surpassing $3,500 per troy ounce—an unprecedented peak that even outstrips historical highs adjusted for inflation. Experts attribute this phenomenon to various factors, including shifts in U.S. trade policies and a growing sense of geopolitical unease. Zoe Lyons, managing director at Hatton Garden Metals, notes a palpable excitement among sellers, who often find themselves waiting in lines to cash in on their treasures.

Understanding the Drivers Behind the Surge

The current gold boom can be seen as a ‘perfect storm’ according to analysts like Louise Street from the World Gold Council. Rising inflation fears and the uncertain economic landscape have led many to view gold as a reliable asset. While it may not provide dividends or interest like stocks and bonds, its physical nature offers a sense of security in an increasingly unstable financial environment.

Central Banks and the Quest for Stability

A significant factor in the current demand for gold is the aggressive purchasing by central banks. Institutions around the world have been stockpiling gold at an unprecedented rate, with over 1,000 tonnes bought annually since 2022. This trend underscores a collective desire for stability amidst global volatility, as nations reconsider the safety of their reserves in a landscape fraught with geopolitical tensions.

The Fear of Dollar Dependency

Countries like Russia and China have ramped up their gold acquisitions, motivated by concerns over the potential weaponization of the dollar system. As Simon French from Panmure Liberum suggests, the need for a non-political asset is becoming increasingly attractive for nations wary of aligning too closely with Western powers.

Caution Amidst the Excitement

Despite the current enthusiasm, experts warn that the rapid ascent of gold prices could signal an impending correction. Historical patterns indicate that substantial price increases often precede sharp declines. The question looms: is the market heading toward a bubble, and how long can this upward momentum last?

Market Predictions and Investor Strategies

Forecasts vary, with some predicting gold could reach $4,000 per ounce in the next few years, while others caution that an oversupply and decreased demand from central banks could lead to significant price drops. Jon Mills from Morningstar emphasizes the importance of diversification, urging investors to avoid placing all their resources in gold, which could lead to substantial losses if the market reverses.

The Future of Gold Investment

As the market for gold continues to evolve, the blend of excitement and caution will define the path ahead. Investors must navigate this landscape with care, balancing the allure of gold’s stability against the potential for volatility. As Zoe Lyons succinctly puts it, many are eager for their share of the golden opportunity, but the question remains: how sustainable is this rush?